Hi,

At the Open and Embedded Insurance Observatory, we perform ongoing research and market intelligence on Open and Embedded Insurance. As a valuable member of the Observatory, we are delighted to share with you our selection of key facts, insights, and news that we consider meaningful and relevant.

Thank you for your support and we hope you will find these resources useful for your business.

Performance update from Nimbla, the pioneer of embedded credit insurance.

Nimbla, one of our UK members, recently shared an update on their business performance, and we looked at it with great interest.

The Nimbla brand name, easy to imagine, comes from “nimbler”, nimbler than traditional insurance providers. Nimbla is a tech MGA operating in the invoice insurance space, with a fully embedded model. They are on business since 2016 and are one of the pioneers of embedded insurance. They use algorithms to assess the risk of the invoices issued by their SME clients, and they provide real-time quotes to let SMEs insure their invoices, directly integrating with the accounting software SMEs use to run their businesses.

As an MGA their capacity providers are Accelerant and Greenlight Re. As a provider of tech-embedded insurance capabilities, they recently launched their own solution called Tradecreditech (TCT).

Nimbla has recently closed a record quarter, registering a 40% QoQ GWP growth and a 40% 2022 Loss Ratio.

This is a remarkable result, proving they are fully in control of the adverse selection risk brought by their business model. With their model, indeed, they have completely flipped the traditional approach to invoice insurance, which requires clients to insure all or a big part of their portfolio of credit risks: with Nimbla SMEs can insure only the invoices they want to insure.

The vast majority of their business to date has come from “gap-fill”. SMEs normally have a whole turnover policy elsewhere, but they have gaps (buyers) that their insurers will not cover. Nimbla believed there was an area of opportunity there and indeed has been writing this business since 2016, in a stressed market inviting "adverse selection". Despite this, they have a loss ratio that matches, if not beats, the incumbents (see image below). And now they are no longer being kept away from the whole turnover. That means very simply, they can cover all the risks their competitors do and the ones they don’t. That means a massive opportunity for them to continue growing their GWP while maintaining their excellent underwriting performances.

What’s more, they know where they can improve their loss ratio. Nimbla loss ratio with ERP integration is 24% and without 50%. This is their edge – data. Better data equals better underwriting, done right it can also align interest. They claim they have no interest in creating a paper-based product because it does not bring them data. So their whole turnover products are digital, dynamic, on-demand, and data-driven. To adopt these products they need to give their customers more and not just more coverage. Their products are embedded within the activities (invoicing typically) that are relevant to what they are helping with and they can give relevant information at the right time. That aligns with interest, it means a time-poor SME is focused at that moment on the risk of their customer, getting the information they need, and of course the comfort of knowing they are protecting that revenue.

Extended Warranties Opportunity in the Auto Segment: A Chat with Element.

Our Founder and Director Yuri Poletto recently published an article on LinkedIn including an analysis of the opportunities in the extended warranties market and the innovation Element is bringing, and an interview with Element’s COO Philipp Hartz.

Here are more news we found insightful and worth-reading.

Amazon & insurance.

Amazon announced the launch of the Amazon Insurance Store—a new, simple, and convenient way for UK customers to shop for home insurance. The store offers an improved shopping experience for home insurance with like-for-like quote comparisons that customers can trust, a streamlined and simple quote questionnaire, and a checkout experience integrated with amazon.co.uk. The Amazon Insurance Store started rolling out to select customers, and it will be available to all UK customers on amazon.co.uk/insurance and the Amazon UK mobile app by the end of the year (read more here, here and here for insightful analyses of this launch).

A new embedded insurance vertical: logistics.

Overhaul, a software-based, supply-chain visibility, risk, compliance, and insurance solution for the world's leading brands, has unveiled an innovative insurance offering for the modern supply chain. Leveraging the company's industry-leading Risk Technology platform and proven results reducing risk exposures, Overhaul's Shipper's Interest Insurance Program is designed to help middle-market shippers significantly reduce losses while improving their overall supply chain performance. (read more here, here, and here).

New device protection solution from Bolttech (in Italy).

Bolttech announced the expansion of its existing partnership with WINDTRE with the launch of a new ‘Reload exChange’ trade-in program in Italy. With this new product, WINDTRE customers can now trade in their used phones in-store and receive cash payments directly to their bank accounts. Reload exChange adds to a suite of device protection offerings already available to WINDTRE’s customers in Italy, including the ‘Smartphone Reload’ phone switch and ‘Reload Plus’ device upgrade. With Reload exChange, a diagnostic app is used to determine the trade-in value of smartphones and customers will be able to receive an instant price quotation. The technology provides assurance of an accurate appraisal of the used device condition and ensures that customers receive a valuation that is fairly priced (read more here).

Opportunities for embedded insurance in the motor insurance market.

For more than a century, carmakers and automobile insurers have largely kept to their own lanes. That was before data ruled. In 2022 data and technology have inspired the automobile industry to get more involved in the insurance side of the ledger, prompting an increase in the number of inter-industry partnerships and more (read more here)

Market Intelligence

September - October 2022 | Embedded Insurance Partnerships and Open and Embedded Insurance Funding Rounds

In the latest months we have spotted a number of new embedded insurance partnerships and funding rounds such as:

Embedded Insurance Distribution Partners Survey

Part of the observatory’s work is to conduct research to build the most rigorous knowledge base on open and embedded insurance.

We are now running a research stream focusing on the distribution side of embedded insurance, and we would like to ask for your help to spread this research. If you are a distributor of embedded insurance, please feel free to take the survey. If you are an enabler or an insurance provider, it would be great if you could help us with the research by sharing it with your distribution partners.

There are more details on the survey form. Click the button below to proceed to the short survey.

And as a way of saying thanks to all of you who support us until this last quarter of 2022 (and onwards), we are happy to share our recently concluded webinars for you to watch in case you missed it.

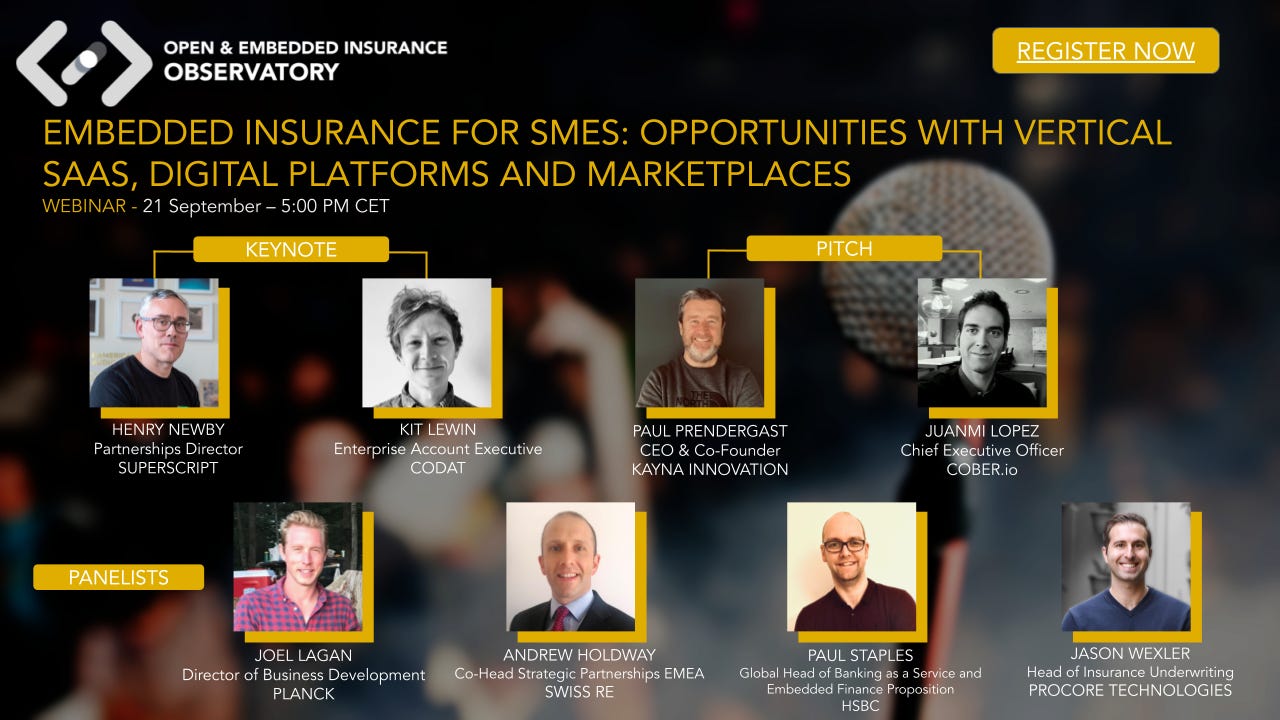

September Webinar

Embedded Insurance for SMEs: Opportunities with Vertical SaaS, Digital Platforms and Marketplaces

Significant growth opportunities for all players within the SME ecosystem continues to arise aiming to close the gap of the estimated 50% underinsured SMEs around the world.

In this webinar we had a closer look on how embedded insurance can harness technology and data to unlock new market opportunities in the SME insurance segment.

The speakers also covered the following topics:

What are the insurance trends and challenges across the SME segment?

How is the SME customer behavior changing, and how can you prepare for the SME of tomorrow?

How will embedded insurance harness the potential of technology and data to better serve SMEs?

What are the main embedded finance trends, and what can the insurance players learn from embedded finance players?

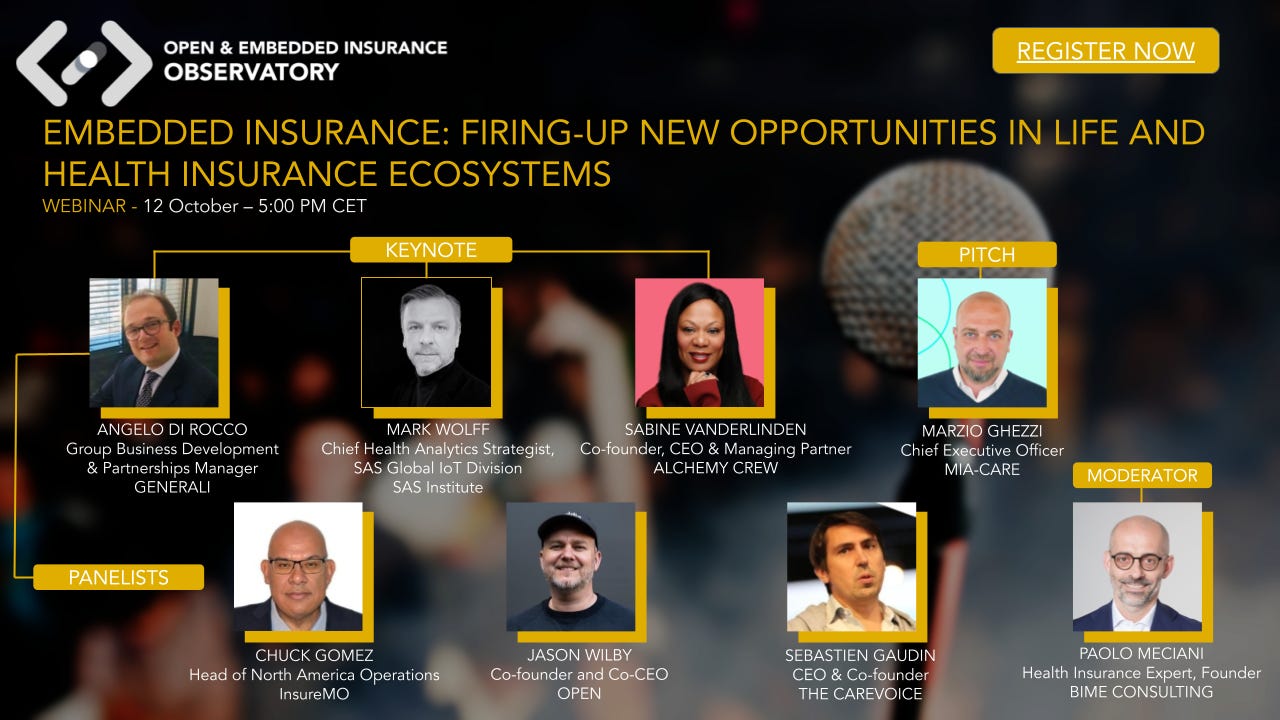

October Webinar

Embedded insurance: firing-up new opportunities in life and health insurance ecosystems

With the promise of providing seamless and customized health and life insurance services in the day-to-day life of people, embedded life and health insurance is widely considered by the industry players as the most relevant opportunity to tap into new untouched customer bases and to reduce the life and health protection gap.

The discussion of the speakers who were carefully selected as experts in health and life insurance revolved around the following topics:

What are the health and life insurance trends and challenges?

How are people's health preferences and behaviour changing, and how shall the health and life ecosystem players adapt to exploit the opportunity?

How will embedded insurance leverage the potential of technology and data to better serve customers and reduce the life and health protection gap?

How is the embedded life and health ecosystem evolving, what role can big techs play, and how will the collaboration between insurers, insurtechs and distribution partners change the current scenario?

November Webinar

Transforming Personal Lines Insurance with Embedded Experiences

We would also like to encourage you to join us and the rest of the 350 attendees (and counting) for another informative webinar on personal lines insurance.

It is free to attend but be sure to register so we can save a spot for you!

Link to the webinar details on LinkedIn: https://bit.ly/3Uz6QfI

And finally, to officially close 2022 we have the most awaited webinar on December 14 at 5:00 PM CET entitled:

Wrapping-up 2022: What are the Underlying Shifts Driving the Growth of Embedded Insurance, and What Can We Expect in 2023?

We have a very strong line up of speakers for this segment so don’t miss out!

Stay tuned for more details so don’t forget to subscribe to our newsletter below to receive further updates.